Economists have hotly debated the underlying causes for rising income inequality in the United States and the extent to which investments in education could help address the problem.

Now Ben S. Bernanke, the chairman of the Federal Reserve Board, has weighed in on the debate.

In a speech last week before the Greater Omaha Chamber of Commerce, Mr. Bernanke described the large wage returns on education and skill as “likely the single greatest source of the long-term increase in inequality.”

“A substantial body of research demonstrates that investments in education and training pay high rates of return both to individuals and to the society at large,” he said on Feb. 6, according to a transcript of the event. “That research also suggests that workers with more education are better positioned to adapt to changing demands in the workplace.”

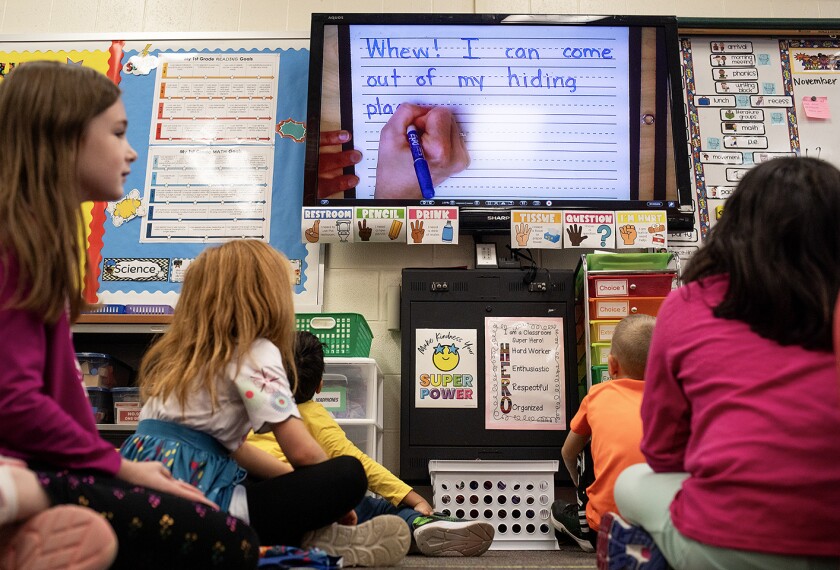

Mr. Bernanke, who succeeded Alan Greenspan as Federal Reserve chairman a year ago, defined education broadly, noting: “Substantial economic benefits may result from any form of training that helps individuals acquire economically and socially useful skills, including not only K-12 education, college, and graduate work but also on-the-job training, coursework at community colleges and vocational schools, extension courses, online education, and training in financial literacy.”

“The market incentives for individuals to invest in their own skills are strong, and the expanding array of educational offerings available today allows such investment to be as occupationally focused as desired and to take place at any point in an individual’s life,” Mr. Bernanke added.

But the chairman echoed many other economists in stressing the importance of starting early, pointing to research that has documented the high returns that early-childhood programs can pay in subsequent educational attainment and lower rates of social problems, such as teenage pregnancy and welfare dependency.

“The most successful early-childhood programs appear to be those that cultivate both cognitive and noncognitive skills and that engage families in stimulating learning at home,” he said.