Financial education in the nation’s schools seems to have taken one step ahead and a half-step back.

Forty-nine states and the District of Columbia include economics in their academic standards—that’s up from 38 in 1998, according to the National Council on Economic Education, a group based in New York City. In addition, 17 states require high schools to offer an economics course, and 15 states have made it a graduation requirement.

Yet a hard-won $1.5 million federal grant for economic education has been tagged for elimination in President Bush’s budget plan for fiscal 2006. And the proposed cut comes as a new national survey shows that many college students are, if not financially illiterate, then fiscally challenged.

The NCEE was the first recipient in 2004 of what is called the Excellence in Economic Education Grant. Over the past year, the NCEE has used that money to award mini-grants to more than 100 nonprofit groups, universities, and schools for financial-literacy teacher training, classroom materials, and economic education research.

Chad Colby, a spokesman for the U.S. Department of Education, said the program may be cut because it has a limited impact.

The grant’s uncertain status concerns Robert F. Duvall, the chief executive officer and president of the NCEE.

“I cannot understand the rationale for penciling out this program,” he said.

Personal savings, for example, have dropped from 7 percent of disposable income in 1990 to 1.2 percent in 2004, according to the Bureau of Economic Analysis, a division of the U.S. Department of Commerce.

Young Americans don’t seem to be doing any better, according to a new survey for Citi Credit-ED, a credit education program run by Citigroup, the giant financial-services company based in New York City.

While 90 percent of the 1,060 college students surveyed said that good credit is important, a third have missed a credit-card payment or paid one late, according to the survey conducted by Harris Interactive Inc., a Rochester, N.Y.-based market-research firm.

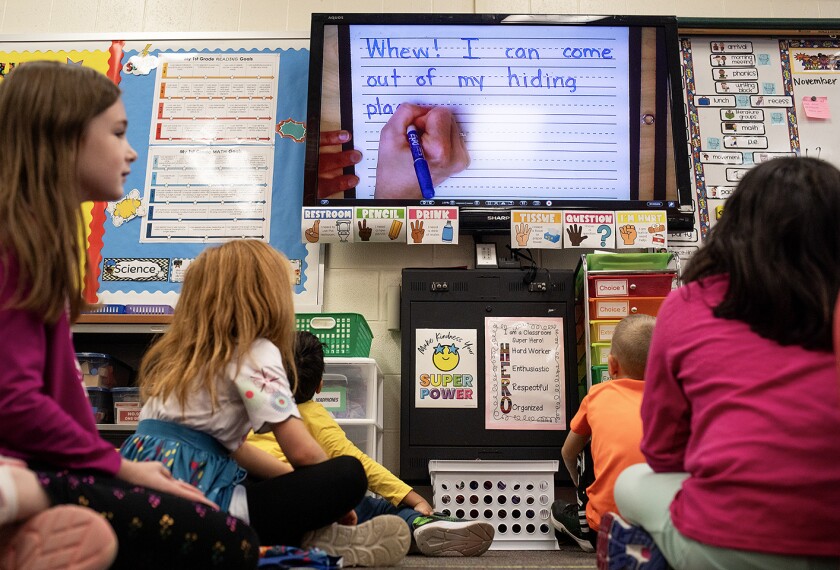

“We’ve got to get to kids precollege,” Mr. Duvall said. “Financial literacy is not something you’re born with. It’s a learned behavior. And you’re either going to learn it from teachers, or you’re going to learn it the hard way.”