UPDATED

When President Donald Trump signed a new tax code into law last December, he approved a change to federally backed college savings plans that school choice advocates said would help their cause. It’s been a rare bright spot for choice supporters at the federal level since Trump took office.

So as we approach the end of 2018, how have states responded to this new landscape? And what are some key trends for what are known as 529 plans, after a section of the tax code?

First, some background if you need it: The Tax Cuts and Jobs Act changed the rules to allow people who put money into 529 plans—previously reserved for higher education costs—to spend up to $10,000 annually on K-12 expenses, including private school tuition. However, that shift didn’t impact state rules for 529 plans, which are named for a section of the tax code. Without changes or clarification in some states, individuals using 529 savings on elementary and secondary education might still incur state tax penalties even if federal law allowed them to use money that way.

As of mid-July—after the end of many state legislative sessions and after many months for state officials to deliberate—here’s where things stood: 26 states had either approved changes to state policy to remove state tax penalties on using 529 plans for K-12, or else their tax codes automatically conformed to the federal code when it comes to these plans. That’s according to the Foundation for Excellence in Education, a nonprofit group that supports school choice and is led by former Florida Gov. Jeb Bush. Other states have no state income tax, so the change to 529 plans didn’t have the potential to impact their tax revenue.

Eight states proactively changed their policies to conform to the federal tax code through legislation or other means, including Arkansas, Idaho, Iowa, Kentucky, Louisiana, North Carolina, Ohio, and Wisconsin, the foundation says. One state, however, shifted its tax code in the opposite direction: Oregon disconnected its tax code from the federal system when it comes to 529s, so that families won’t be able to use the plans on tuition or other educational expenses without a state tax penalty.

And a few states are still considering the issue. In Michigan, for example, Attorney General Bill Schuette said in June that he could not provide a formal opinion on the status of these 529 plans with respect to the state tax code, because the issue was under review in separate court cases and that his office represented parties to those cases.

Need all that in map form? The Foundation for Excellence in Education, along with the American Federation for Children and EdChoice, have color-coded it for you:

So, will states that removed tax penalties spur a huge wave of interest (and money) in 529 plans for private school tuition and other educational services? Not necessarily, said Tori Bell, a policy analyst at the foundation.

“It’s a policy change that expands educational opportunity for families,” Bell said. “But it’s not an educational panacea.”

Shortly before Trump signed the tax bill. Secretary of Education Betsy DeVos called the 529 shift a “step in the right direction,” but also acknowledged that it might not do much to help families that don’t have much money to set aside in the first place.

Perhaps driven by decisions from affluent families, the value of 529 state-sponsored plans has grown significantly in recent years, according to research from the Pew Charitable Trusts published Monday.

From 2010 to 2017, the total number of accounts rose from 10 million to 13 million, even though the population of people under 18 didn’t change much, Pew says. The total assets in state-sponsored 529 plans grew from an inflation-adjusted $176.2 billion to $318.7 billion. That’s an increase of 81 percent. In 2017, the tax cost of the 529 plans to Washington was $2 billion, according to Pew. In federal education budget terms, that’s nearly the value of the Title II program at the U.S. Department of Education that funds professional development for educators.

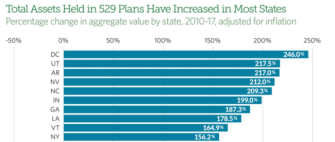

Where has the value of assets in these state-backed 529 plans grown the most? Here’s a chart from Pew to help you with the top 10 jurisdictions in terms of growth:

“As policymakers consider the implications of changes both enacted and proposed, they should be aware that the costs—meaning the forgone revenue—of 529 plans were already rising,” Phillip Oliff, Laura Pontari, and Rebecca Thiess write for Pew. “This spending through the tax code has historically been a small part of the total federal support for higher education, but the costs related to 529 plans have grown in recent years along with participation.”